The U.S. is Losing Credibility in the Currency Markets

by Phoenix Capita…Fri, 12/04/2020 – 09:19

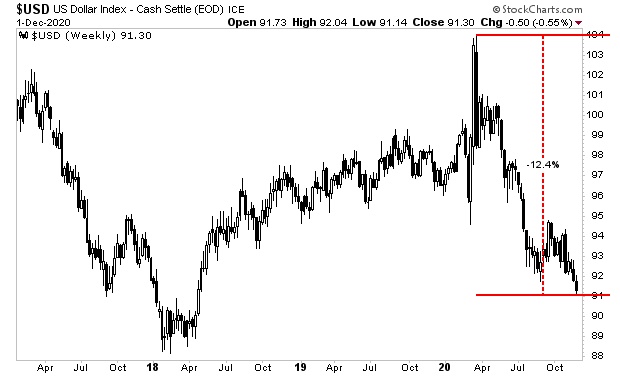

The $USD continues to drop like a stone.

Earlier this week it plunged to new lows for the year. And peak to trough it has lost nearly 13%.

The important point here is NOT the level at which the $USD is trading. After all, it’s been at 91 on the $USD index plenty of times before.

In the currency markets, the SPEED at which a currency moves is just as important as the actual price at which a currency is trading. A currency can trade at practically any level without it being a cause for major concern, provided it gets there in an orderly fashion.

It’s when a currency starts moving RAPIDLY that things become ugly quickly. Which brings us to item the REAL issue at stake:

What’s driving this drop in the $USD?

The collapse of confidence in the institutions and credibility of the U.S. as a nation.

It is now clear beyond any doubt that the 2020 U.S. Presidential election was rife with fraud.

Now, fraud occurs in every election. Anyone who argues otherwise hasn’t studied history. When it comes to fraud in major elections in the U.S. it’s NOT a question of “if” but of “how much.”

In the case of the 2020 U.S. Presidential election it is now clear that the degree of fraud was astonishing. I’m not going to delve into this topic at length in these pages, but in the last few weeks we’ve seen:

- Whistleblowers state during testimony that they witnessed:

- Trucks with hundreds of thousands of ballots being driven from one state to another to deliver the ballots in a different election.

- Tens if not hundreds of thousands of ballots being fed and refed into tabulating machines as much as 8 to 10 times (meaning the same ballot counts as 8 or even 10 votes).

- Vote counters being told to “backdate” ballots so that the ballots were claimed to have arrive before the deadline.

- The voting machine/ software used to tabulate the vote totals in at LEAST 24 states were:

- Connected to the internet, allowing for outside interference.

- Written in such a way that anyone can change a given ballot’s vote after it has been cast.

- That at least one foreign government (China) FORMALLY owns the company that counted the ballots (there is an SEC filing of the acquisition).

- Other nations (Cuba, Venezuela) have also been linked to the company.

Regardless of your political views or your desired outcome for this election, the above items alone call into question the entire election’s legitimacy.

Think it this way. Let’s say that during the 100M dash in the Olympics, the timer stopped working, the judges wore blindfolds and the camera feeds all shutdown mid-way through the race.

Would you trust or believe it if one of the racers claimed that he not only won the race despite trailing his opponent by two seconds… but that he also set a world record time? Would you even consider the race legitimate?

I believe the current rapid collapse in the $USD is telling us that the currency markets (the largest most liquid markets in the world, and most sensitive to systemic changes) believe the U.S. has lost credibility as a country on the global stage.

I do not write that last paragraph carelessly.

The U.S. has long held a prestige due to its adherence to the Rule of Law and the transparency and credibility of its institutions.

I want to be clear here: I’m not saying the U.S. is void of fraud or scams; I’m simply stating that the country’s legal system and institutions are set up with enough checks and balances that generally speaking systemic fraud is less likely here.

This is one reason why the U.S. stock markets typically attract so much capital from global investors: the world knows the U.S. has credible accounting standards and creditworthiness.

A rigged U.S. Presidential election involving such abject systemic fraud indicates that U.S. institutions are no longer credible. This would effectively signify the U.S. becoming something of a dying empire or a banana republic.

And that is why the $USD is collapsing so rapidly.